Book Value per Share Formula with Calculator

Book value per share (BVPS) measures the book value of a firm on a per-share basis. BVPS is found by dividing equity available to common shareholders by the number of outstanding shares. If XYZ can generate higher profits and use those profits to buy more assets or reduce liabilities, the firm’s common equity increases. If, for example, the company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, common equity increases along with BVPS. On the other hand, if XYZ uses $300,000 of the earnings to reduce liabilities, common equity also increases. The book value per share (BVPS) metric helps investors gauge whether a stock price is undervalued by comparing it to the firm’s market value per share.

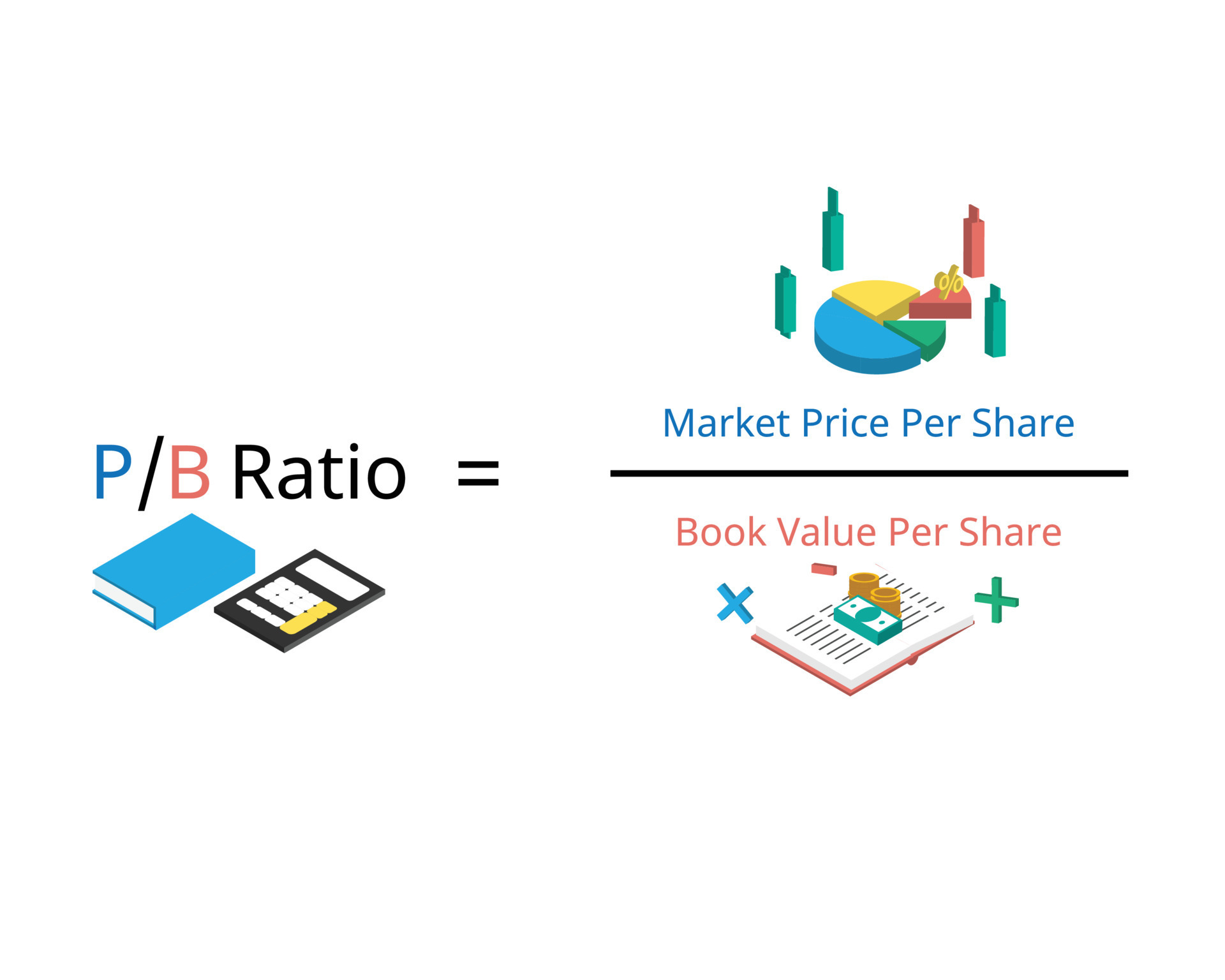

Price-to-Book (P/B) Ratio

- You just have to click on the Price to tangible book ratio option to uncover these additional values.

- If a company has a book value per share that’s higher than its market value per share, it’s an undervalued stock.

- You should consider here all non-physical assets such as goodwill and intangible assets recorded by the acquisition of another company.

- This means that each share of stock would be worth $1 if the company got liquidated.

Despite the increase in share price (and market capitalization), the book value of equity per share (BVPS) remained unchanged in Year 1 and 2. If we assume the company has preferred equity of $3mm and a weighted average share count of 4mm, the BVPS is $3.00 (calculated as $15mm less $3mm, divided by 4mm shares). Often called shareholders equity, the “book value of equity” is an accrual accounting-based metric prepared for bookkeeping purposes and recorded on the balance sheet. BVPS represents the minimum value of a company’s equity, assuming the company’s assets would be sold at their carrying value.

How to Interpret BVPS?

In this case, each share of stock would be worth $0.50 if the company got liquidated. Let’s say that Company A has $12 million in stockholders’ equity, $2 million of preferred stock, and an average of 2,500,000 shares outstanding. You can use the book value per share formula to help calculate the book value per share of the company. While BVPS considers the residual equity per-share for a company’s stock, net asset value, or NAV, is a per-share value calculated for a mutual fund or an exchange-traded fund, or ETF. For any of these investments, the NAV is calculated by dividing the total value of all the fund’s securities by the total number of outstanding fund shares. Total annual return is considered by a number of analysts to be a better, more accurate gauge of a mutual fund’s performance, but the NAV is still used as a handy interim evaluation tool.

Book Value per Share Calculator

Undervalued stock that is trading well below its book value can be an attractive option for some investors. It depends on a number of factors, such as the company’s financial statements, competitive landscape, and management team. Even if a company has a high book value per share, there’s no guarantee that it will be a successful investment.

To get BVPS, you divide the figure for total common shareholders‘ equity by the total number of outstanding common shares. To obtain the figure for total common shareholders‘ equity, take the figure for total shareholders‘ equity and subtract any preferred stock value. If there is no preferred stock, then simply use the figure for total shareholder equity. The book value per share (BVPS) ratio compares the equity held by common stockholders to the total number of outstanding shares. To put it simply, this calculates a company’s per-share total assets less total liabilities. Book value per common share (or, simply book value per share – BVPS) is a method to calculate the per-share book value of a company based on common shareholders‘ equity in the company.

Price to Book Ratio Calculator

We can say that if the market-to-book ratio is high, the market has huge expectations for the business’s future. Meanwhile, when such a ratio is low, it expresses investors‘ how to use xero tracking categories disbelief regarding the company. The book value per share of a company is the total value of the company’s net assets divided by the number of shares that are outstanding.

Value investors look for relatively low book values (using metrics like P/B ratio or BVPS) but otherwise strong fundamentals in their quest to find undervalued companies. The figure of 1.25 indicates that the market has priced shares at a premium to the book value of a share. BVPS is typically calculated and published periodically, such as quarterly or annually. This infrequency means that BVPS may not always reflect the most up-to-date value of a company’s assets and liabilities. The formula for BVPS involves taking the book value of equity and dividing that figure by the weighted average of shares outstanding.

Now, let’s say that you’re considering investing in either Company A or Company B. Given that Company B has a higher book value per share, you might find it tempting to invest in that company. However, you would need to do some more research before making a final decision. There are other factors that you need to take into consideration before making an investment. However, book value per share can be a useful metric to keep in mind when you’re analyzing potential investments.

Assume XYZ repurchases 200,000 shares of stock, and 800,000 shares remain outstanding. The company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, its common equity increases along with BVPS. If XYZ uses $300,000 of its earnings to reduce liabilities, common equity also increases. A good BVPS is typically higher than the current market price of the shares, indicating that the shares may be undervalued and have potential for profit.

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Uloženo dne 25.10.2023.

Rubrika Bookkeeping.

Komentářů: 0.