How to Value an Insurance Book of Business

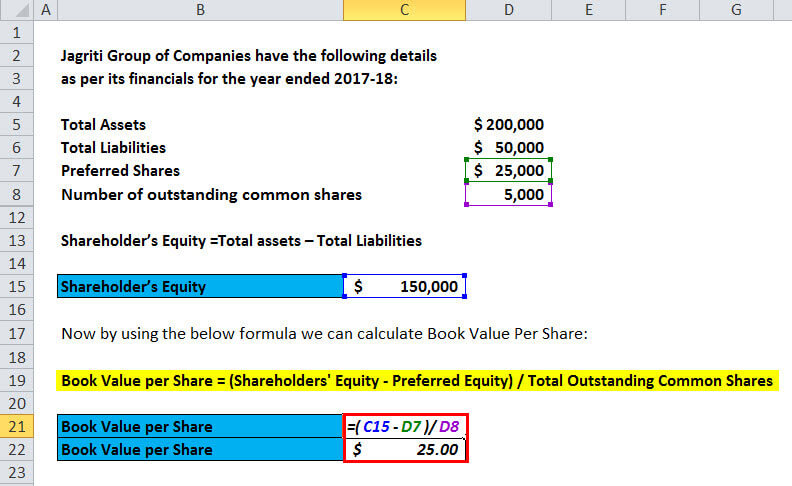

If XYZ uses $300,000 of its earnings to reduce liabilities, common equity also increases. The price per book value is a way of measuring the value offered by a firm’s shares. It is possible to get the price per book value by dividing the market price of a company’s shares by its book value per share.

Great! The Financial Professional Will Get Back To You Soon.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. All three terms can be used interchangeably because they refer to the same thing – the true market value of an asset at any given point in time. In reality, carrying value does not always reflect what shareholders will receive in the event of liquidation. Common Equity ltd reports below the number at the closure of its annual books of account. Take a proactive step today and use our Agency Value Calculator to unlock insights and confidently steer your business decisions. While the pricing information can be quite useful, the main disadvantage of searching NADA RV values is the user experience.

Ask a Financial Professional Any Question

The net book value (NBV) is most applicable to fixed assets (PP&E), which must be capitalized on the balance sheet since their useful life assumption is expected to exceed twelve months. After the initial purchase of an asset, there is no accumulated depreciation yet, so the book value is the cost. Then, as time goes on, the cost stays the same, but the accumulated depreciation increases, so the book value decreases. When the market value is near or less than the book value, the P/B ratio will be 1 or less, signaling that the stock may be undervalued. An undervalued stock can be a great bargain, particularly if company fundamentals are strong and the investor has a long timeline.

Premium Investing Services

In this case, the stock seems to trade at a multiple that is roughly in line with its peers. If the company is going through a period of cyclical losses, it may not have positive trailing earnings or operating cash flows. Therefore, an alternative to the P/E approach may be used to assess the current value of the stock. This is especially applicable when the analyst has low visibility of the company’s future earnings prospects. It can and should be used as a supplement to other valuation approaches such as the PE approach or discounted cash flow approaches. Like other multiple-based approaches, the trend in price/BVPS can be assessed over time or compared to multiples of similar companies to assess relative value.

What Is Price Per Book Value?

Most of the companies in the top indexes meet this standard, as seen from the examples of Microsoft and Walmart mentioned above. However, it may also indicate overvalued or overbought stocks trading at high prices. The market value represents the value of a company according to the stock market. In the context of companies, market value is equal to market capitalization. It is a dollar amount computed based on the current market price of the company’s shares. It had total assets of about $252.39 billion and total liabilities of approximately $161.83 billion for the fiscal year ending January 2024.

You can’t use the depreciation of your personal car to reduce your annual taxable income—the government doesn’t consider the two things related. Therefore, the calculation still works, but the resulting figure is meaningless. There are legal limits on how many years a company can write off depreciation costs. If an asset is owned long enough, the book value may only represent salvage or scrap value. At that point, the asset is considered to be „off the books.“ That doesn’t mean the asset must be scrapped or that the asset doesn’t have value to the company. It just means that the asset has no value on the balance sheet—it has already maximized the potential tax benefits to the business.

- You shouldn’t judge a book by its cover, and you shouldn’t judge a company by the cover it puts on its book value.

- He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

- Therefore, an alternative to the P/E approach may be used to assess the current value of the stock.

- NADA RV values include a suggested list price, a low retail price, and an average retail price.

- If XYZ uses $300,000 of its earnings to reduce liabilities, common equity also increases.

- Some of these adjustments, such as depreciation, may not be easy to understand and assess.

The increased importance of intangibles and difficulty assigning values for them raises questions about book value. As technology advances, factors like intellectual property play larger parts in determining profitability. Ultimately, accountants must come up with a way of consistently valuing intangibles to keep book value up to date.

NADA RV values include a suggested list price, a low retail price, and an average retail price. One advantage this site offers is the ability to research base RV pricing or input features and options across various categories for a more accurate valuation. Investors can find a company’s financial information in quarterly and annual reports on its investor relations page. However, it is often easier to get the information by going to a ticker, such as AAPL, and scrolling down to the fundamental data section.

The book value of an asset is the value of that asset on the „books“ (the accounting books and the balance sheet) of a company. Businesses can use this calculation to determine how much depreciation costs they can write off on their taxes. Since book value is strictly an accounting and tax calculation, it may not always perfectly align with the fair market value of an asset. When the market value is higher than the book value, the P/B ratio will be greater than 1. This means investors are willing to risk more than BVPS for the stock’s potential upside. If the book value is based largely on equipment, rather than something that doesn’t rapidly depreciate (oil, land, etc.), it’s vital that you look beyond the ratio and into the components.

The answer could be that the market is unfairly battering the company, but it’s equally probable that the stated book value does not represent the real value of the assets. Companies account for their assets in different ways in different industries, and sometimes even within the same industry. This muddles book value, creating as many value traps as value opportunities. The formula review of the independence and effectiveness of the operations evaluation department states that the numerator part is what the firm receives by the issuance of common equity. That figure increases or decreases depending upon whether the company is making a profit or loss, and then finally, it decreases by issuing dividends and preference stock. However, the market value per share—a forward-looking metric—accounts for a company’s future earning power.

That number is constant unless a company pursues specific corporate actions. Therefore, market value changes nearly always occur because of per-share price changes. Some of these adjustments, such as depreciation, may not be easy to understand and assess. If the company has been depreciating its assets, investors might need several years of financial statements to understand its impact. Additionally, depreciation-linked rules and accounting practices can create other issues. For instance, a company may have to report an overly high value for some of its equipment.

Uloženo dne 17.2.2023.

Rubrika Bookkeeping.

Komentářů: 0.