Order of Liquidity How to Report Balance Sheet Assets?

The aggregator also typically integrates smart order routing, which ensures that orders are split or routed to the exchange with the best price and liquidity. This combination of sources doesn’t just broaden liquidity; it transforms the trading experience by enabling smoother execution, lower costs, and higher accuracy in fast-moving markets. Moreover, maintaining a robust liquidity position safeguards financial stability during economic downturns, bolstering a company’s resilience against unforeseen challenges.

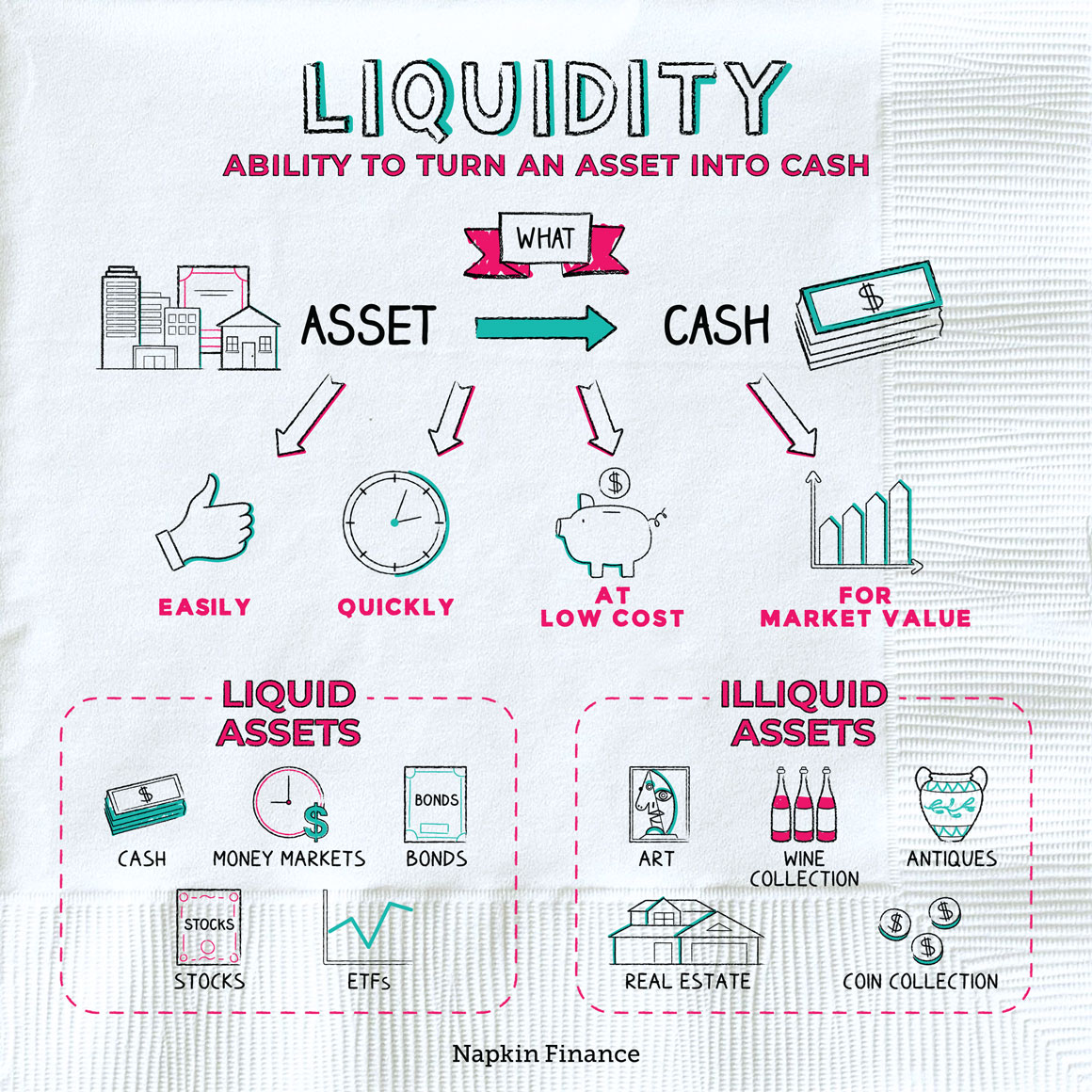

A guide to liquidity in accounting

- One way to measure a firm’s ability to meet its short-term obligations with its liquid assets.

- At Financopedia, we’re committed to assisting small businesses and individuals with their finances and taxes.

- In doing so, it eliminates duplicates, removes any inconsistencies, and recalculates the bid-ask spread across the combined liquidity pool.

- By recognizing the liquidity hierarchy of assets, investors can tailor their portfolios to align with their liquidity preferences, investment horizon, and risk tolerance.

- High liquidity ensures that firms can make these moves promptly without resorting to lengthy financing processes.

A firm with a low debt/worth ratio usually has greater flexibility to borrow in the future. Your inventories are your goods that are available for sale, products that you have in a partial stage of completion, and the materials that you will use to create your products. Similarly, the fixed or long-term liabilities are shown first under the order of permanence method, and the current liabilities are listed afterward. Deferred tax assets arise from temporary differences between accounting and taxable income, and their liquidity may vary based on tax regulations and future profitability expectations. A narrow bid-ask spread indicates high liquidity, as there is minimal disparity between the buying and selling prices, facilitating seamless transactions.

Which of these is most important for your financial advisor to have?

As we move into 2025, aggregated order books present an efficient method for capturing the best trading opportunities across platforms. The pooling of liquidity through aggregated order books offers unique advantages to both traders and exchanges. For traders, access to pooled liquidity means they can see a larger volume of buy and sell orders at each price level, allowing for smoother trade execution with minimal impact on prices. This approach brings tighter bid-ask spreads, helping traders lower transaction costs and obtain the best available prices.

Understanding Order Books: The Core of Every Crypto Trade

By pulling orders from multiple sources, aggregated order books make it easier for traders to complete trades without excessive fluctuations in price. While it’s not the only number you’ll need, liquidity ratios clue you into a company’s ability to cover short-term debts and expenses. Accounts receivable are the amounts billed to your customers and owed to you on the balance sheet’s date. You should label all other accounts receivable appropriately and show them apart from the accounts receivable arising in the course of trade. If these other amounts are currently collectible, they may be classified as current assets. Cash is simply the money on hand and/or on deposit that is available for general business purposes.

Deferred Tax Assets

At the top of the order of liquidity are cash and cash equivalents, which encompass currency, bank deposits, and highly liquid short-term instruments such as Treasury bills and commercial paper. These assets are readily accessible and can be swiftly converted into cash without incurring significant transaction costs or price discounts, making them the most liquid instruments. For investors and fund managers, the importance of liquidity is underscored by its role in portfolio management and risk mitigation. Highly liquid assets offer flexibility, allowing investors to adjust their portfolios in response to changing market conditions, capitalize on investment opportunities, or meet short-term liquidity needs. Additionally, liquidity provides a layer of protection against unforeseen circumstances, as it enables investors to exit positions swiftly in the event of market volatility or adverse developments.

Amazon may up its investment in Anthropic — on one condition

Although ideally, the business owners should be banking all the money, there are cases when one did not have time to go to the nearest bank to do so or it is simply sitting in the safe for various reasons. For example, if a person wants a $1,000 refrigerator, cash is the asset that can most easily be used to obtain it. If that person has no cash but a rare book collection that has been appraised at $1,000, they are unlikely to find someone willing to trade them the refrigerator for their collection. Instead, they will have to sell the collection and use the cash to purchase the refrigerator. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Investors and creditors use these ratios to determine if a company can cover its short-term obligations and to what extent. Conversely, an asset that is considered illiquid cannot be easily converted into cash or is difficult to trade. The next category of things would be assets that take a while to sell without doing so at a loss, which are typically any kind of investments that a business has. For example, you might have shares that you can sell, although it would not be as easy to get cash as with the items listed earlier. The last accounts would include the land, office or manufacturing spaсe, and other similar business property.

On the other hand, illiquid assets such as real estate or long-term investments may pose challenges when immediate cash flow is essential. These expenses are recorded as assets on the balance sheet until the related goods or services are delivered, at which point they are recognized as expenses. what does order of liquidity mean As current assets, prepaid expenses are typically converted into cash within a year, making them crucial for maintaining liquidity. Proper classification of prepaid expenses allows businesses to accurately assess their short-term financial obligations and effectively manage cash flow.

Uloženo dne 5.2.2024.

Rubrika Bookkeeping.

Komentářů: 0.