Solved: Accounting for Estates and Trusts

We’ve chatted with several accounting teams at established firms and found that most are currently using small business accounting software for their trusts. Connecting the trust software with billing and document management systems streamlines workflows. Automating handoffs between systems eliminates tedious copying-pasting or manual data entry.

Accurate Record-Keeping

Complex systems with confusing interfaces often result in errors and frustration that negate efficiency gains. If you’re ready to learn more about adding LeanLaw and QuickBooks Online to your firm’s tech stack, check out our free demo today. However, both LeanLaw and QuickBooks Online are known for their user-friendly interfaces and intuitive workflows, which makes the learning process much smoother and easier to understand. Learning LeanLaw and QuickBooks Online together may require some time and effort, especially if you and/or your staff are new to either software. LeanLaw, on the other hand, is specifically built for the legal industry.

Digital Assets Industry

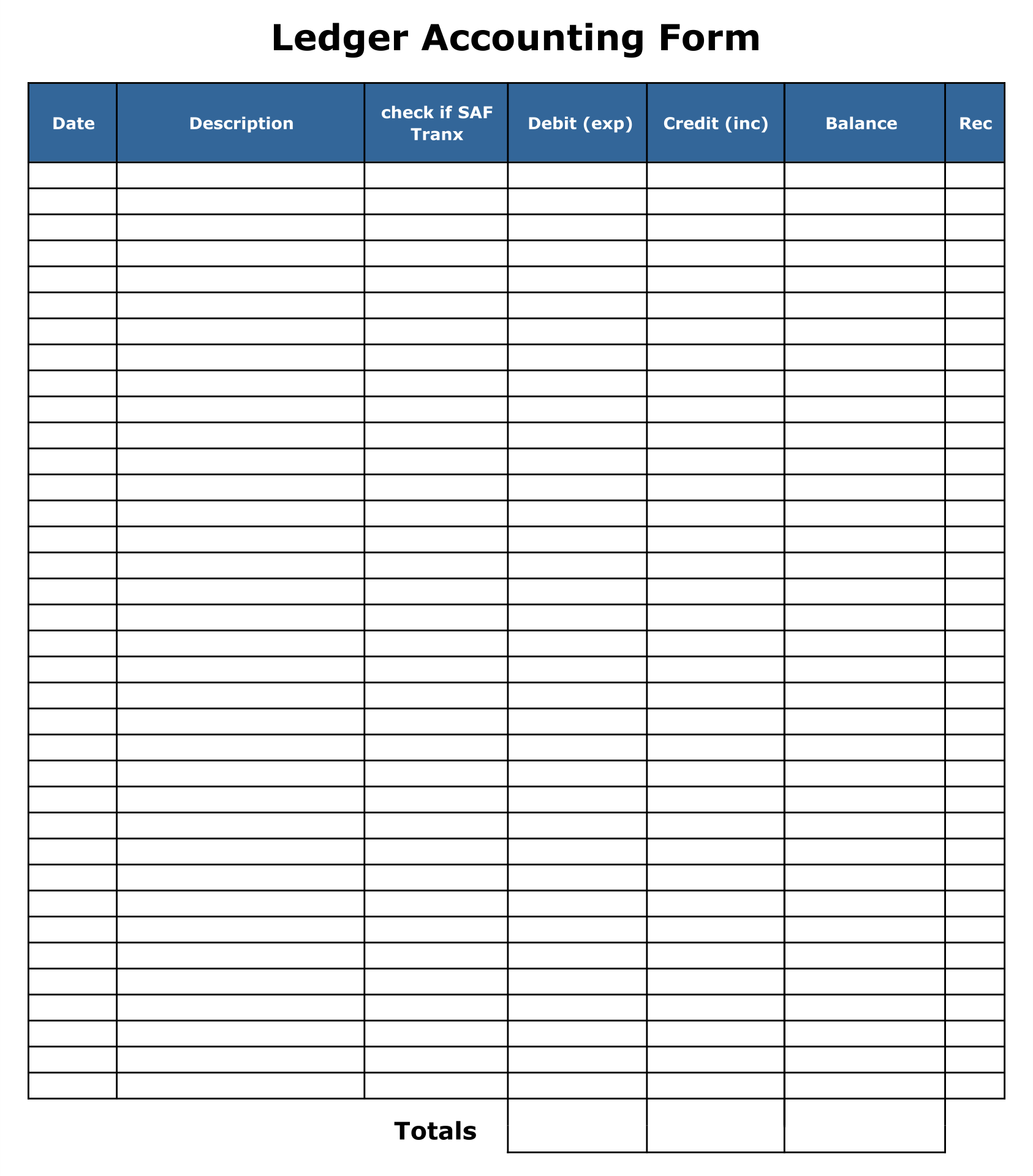

Providing training and support for staff involved in trust accounting and reporting is essential for maintaining accurate records, ensuring compliance, and fostering a culture of professionalism and integrity. Trust account reconciliation is the process of comparing trust account records with bank statements to identify discrepancies, errors, or potential fraud. Regular reconciliation is essential to maintain accurate records, ensure compliance, and safeguard trust assets. Deposits into trust accounts typically include income from trust assets, contributions from the trust grantor, or other sources of trust revenue.

- This intrinsic motivation drives adoption much more than just teaching functionality.

- Cryptocurrencies are becoming increasingly common in accounting processes, so accounting systems are scrambling to evolve and accommodate the increasing demand with add-on crypto tools.

- Your client ledger report lists the client’s deposits and withdrawals activity for their specific trust account.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Features

Yes, QuickBooks Online and LeanLaw can be integrated seamlessly, allowing for the synchronization of data between the two platforms. From your regular operating bank account to your client trust account, QuickBooks Online and LeanLaw can easily work together to make sure each account is always up-t0-date. Software also has a big role to play in reducing risk—and not just the risk of humans making mistakes. Cloud-based solutions, for example, offer strong security such as data encryption to protect sensitive financial data from unauthorized access, fraud, and cyber threats. As a fiduciary, it’s important to be aware of the difference between the fair market value of an asset and its carry value.

When evaluating trust accounting systems, ensure the software supports easy reconciliation workflows. Quality solutions provide side-by-side ledgers and bank register views to match balances. Built-in discrepancy flagging streamlines locating any reconciliation differences. Maintaining separation of financial duties is critical for preventing trust fund misuse or fraud. Quality legal trust accounting software enables configurable access permissions and restrictions for secure, ethical trust fund management.

LeanLaw’s trust accounting engine tracks trust and operating accounts based on industry and state bar compliance standards. Transparency and accountability are essential ethical considerations in trust accounting and reporting. Segregation of trust funds involves keeping trust assets separate from personal or business assets. This practice is vital to prevent the misuse or misappropriation of trust funds and to ensure the proper administration of the trust. QuickBooks can be the key to mastering trust accounting, streamlining your workflows, and providing you with the confidence and peace of mind you need. If you’re seeking a unified solution for case management and legal accounting, Clio could be the perfect fit.

Ensure connections do not restrict making updates from either system or complicate decoupling should needs change. Thoroughly test integrations using real-world data to catch edge cases beforehand. With thoughtful planning guided by user workflows rather than technology alone, integrations magnify productivity gains from the trust accounting system. For smaller firms on a budget, QuickBooks Online Advanced provides adequate trust accounting functionality paired with an accessible price point and intuitive interface. For mid-size to large firms handling complex trust accounting needs and high transaction volumes, Clio’s scalable solution is a top choice. Both QuickBooks Online and LeanLaw are designed with user-friendly interfaces and intuitive workflows, making it relatively easy for law firms to learn and utilize the software effectively.

See invoices paid 70% faster with LeanLaw’s streamlined accounting workflows. With QuickBooks trust accounting for lawyers, transaction syncs fiduciary accounting software quickbooks are fast and accurate. This ensures end-of-month financing is pain-free and your finances are in line with legal ethics requirements.

Unless you have very basic trust accounting needs, QuickBooks Online has too many limitations. Consider migrating to trust accounting software built specifically for the legal industry. This will reduce compliance risks and provide full transparency into your client accounts. Most solutions integrate cleanly with QuickBooks for seamless general ledger syncing too.

Enable agile and confident business decisions with SoftLedger’s real-time software. Control your costs with SoftLedger’s accounts payable automation and approval workflows. Additionally, Clio garners high praise from customers for its outstanding onboarding, training resources, and multi-channel customer support. This helps facilitate an easy setup process and smooth adoption across organizations. Appoint subject matter experts as points of contact for questions and advanced features.

Uloženo dne 19.11.2020.

Rubrika Bookkeeping.

Komentářů: 0.