What is Return on Common Stockholders Equity ROCE? Definition Meaning Example

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Return on Common Equity Explanation (ROCE)

The return on equity (ROE) cannot be used as a standalone metric, as it is prone to be affected by discretionary management decisions and one-time events. The return on equity (ROE) metric provides useful insights into how efficiently existing and new equity invested into the company is being utilized. Typically expressed in percentage form, the ROE metric can be a very useful tool to gauge a management team’s capital allocation decisions and ability to drive shareholder value creation. ROE, therefore, is sometimes used to estimate how efficiently a company’s management is able to generate profit with the assets they have available. These strategies require careful planning and analysis of the company’s financial and operational status to ensure effective implementation.

What Is a Good ROE?

Maximizing your return on common stockholders equity requires careful analysis of a company’s balance sheet, income statement, debt levels, and total equity. You can start by examining the balance sheet and income statement of a company to calculate its ROE ratio, which is equal to a company’s net income divided by its average shareholders’ equity. The return on common equity, or ROCE, is defined as the amount of profit or net income a company earns per investment dollar. This is often beneficial because it allows companies and investors alike to see what sort of return the voting shareholders are getting if preferred and other types of shares are not counted.

- An extremely high ROE can be a good thing if net income is extremely large compared to equity because a company’s performance is so strong.

- A higher ROCE indicates that the company has a better capacity to generate profits with its available equity capital, which is a positive sign for investors.

- A higher return on equity indicates that a company is generating higher profits for equity investors from the net assets invested.

- This could be due to better management, more favorable market conditions, or other factors.

Is a higher ROCE always better?

Return on assets (ROA) and ROE are similar in that they are both trying to gauge how efficiently the company generates its profits. However, ROE compares net income to net assets (assets minus liabilities) of the company, while ROA compares net income to the company’s assets without deducting its liabilities. In both cases, companies in industries in which operations require significant assets will likely show a lower average return.

What is your current financial priority?

A consistent upward trend indicates efficiency improvements, while a downward trend indicates inefficiency and declining profitability. Thirdly, investors should assess the impact of factors such as economic conditions, industry dynamics, and changes in strategy on the company’s ROCE. ROCE is a crucial financial ratio that investors use to evaluate a company’s financial performance and profitability. A higher ROCE indicates that the company has a better capacity to generate profits with its available equity capital, which is a positive sign for investors. It shows that the company is efficiently utilizing its shareholder’s funds and has a better return on investment.

Return on equity vs. return on capital employed

When taken alone, there are a number of ways that the ROE calculation can be misleading. In this case, the net profit before the deduction of dividends on preferred shares is used as the numerator in the formula, while the total of ordinary equity and preferred equity is used as the denominator. In finance, Return on Common Stockholders’ Equity (ROE) is crucial for comparing profitability and growth metrics across different industries and within peer groups.

Simultaneously, strategic financial management aimed at optimizing the equity base can further magnify ROCE. Both the three- and five-step equations provide a deeper understanding of a company’s ROE by examining what is changing in a company rather than looking at one simple ratio. As always with financial statement ratios, they should be examined against the company’s history and its competitors‘ histories. In rare cases, a negative ROE ratio could be due to a cash flow-supported share buyback program and excellent management, but this is the less likely outcome. In any case, a company with a negative ROE cannot be evaluated against other stocks with positive ROE ratios.

It also indicates how profitable it would have been if all funds invested were shared by the investors and it shows how well a company is efficiently using its assets. The return on equity ratio (ROE ratio) is calculated by expressing net profit attributable to ordinary shareholders as a percentage of the company’s equity. For analysts, ROE is a critical measure when comparing the financial performance of companies within the same sector. It enables them to identify which firms are better at converting equity investments into profits.

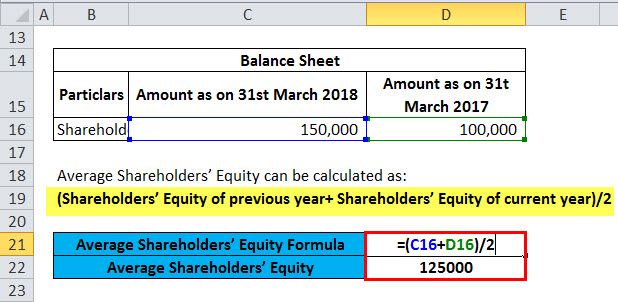

Let’s take the example of Company C, a successful technology company that has consistently reported high profitability and efficiency. NYU professor Aswath Damodaran calculates the average ROE for a number of industries and has determined that the market averaged an ROE of 8.25% as of January 2021. For information pertaining what are operating activities in a business to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Average equity is calculated by adding the equity at the beginning of the year to the equity at the end of the year and dividing the total by 2.

Uloženo dne 10.5.2024.

Rubrika Bookkeeping.

Komentářů: 0.